Balance Sheet Example

If they are divorced, a line for alimony or child support payments might be added to the income or expense section (depending on whether they are paying or receiving these payments). Asset accounts will be noted in descending order what is cash flow from operating activities of maturity, while liabilities will be arranged in ascending order. Under shareholder’s equity, accounts are arranged in decreasing order of priority. These are typically liquid, or likely to be realised within 12 months.

- This document gives detailed information about the assets and liabilities for a given time.

- Current liabilities are the obligations that are expected to be met within a period of one year by using current assets of the business or by the provision of goods or services.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

HOW THE PERSONAL FINANCIAL STATEMENTS ARE RELATED

According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). In practice, the balance sheet offers insights into the current state of a company’s financial position at a predefined point in time, akin to a snapshot. The balance sheet is a report that gives a basic snapshot of the company’s finances. This is an important document for potential investors and loan providers. We’ll do a quick, simple analysis of two balance sheets, so you can get a good idea of how to put financial ratios into play and measure your company’s performance.

Examples of balance sheet analysis

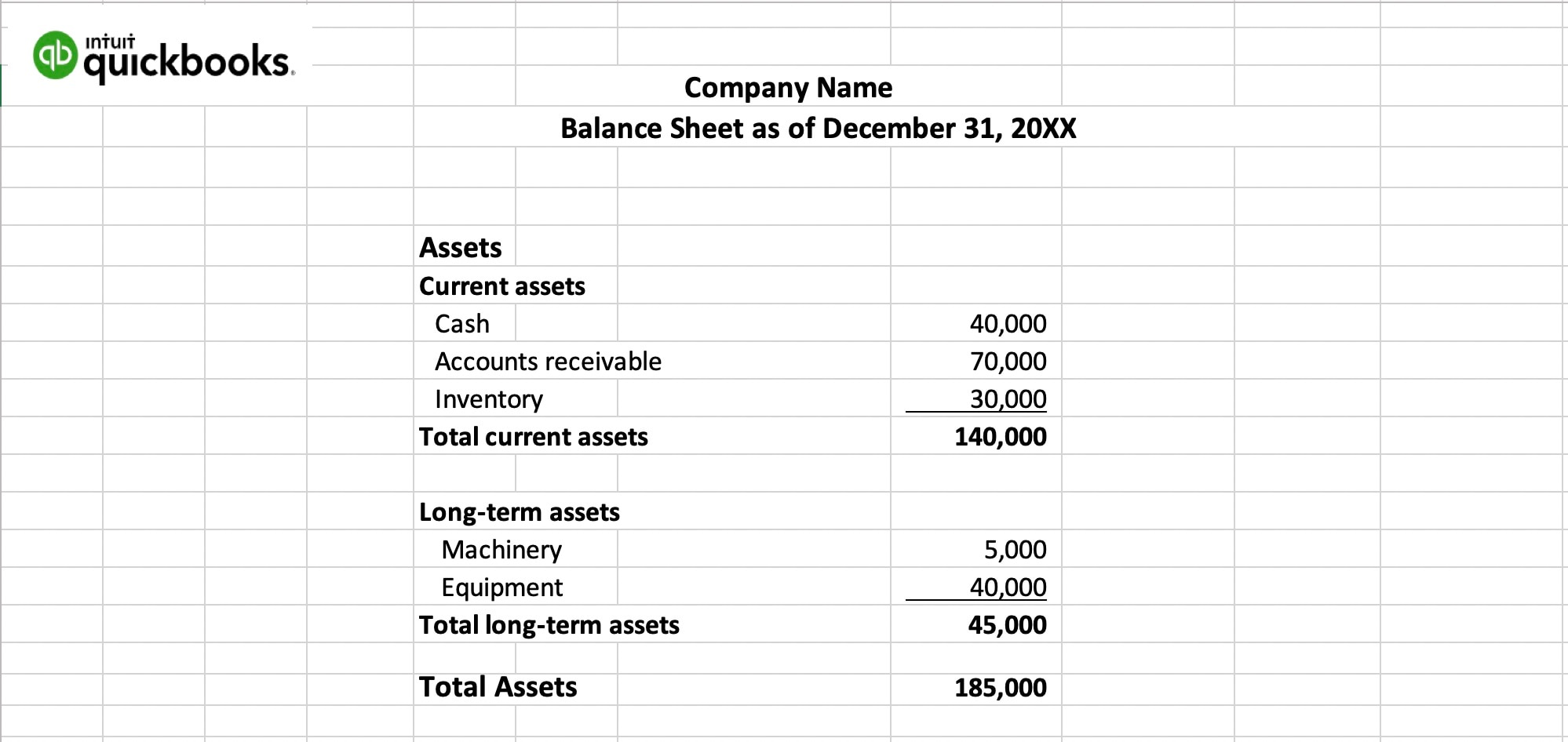

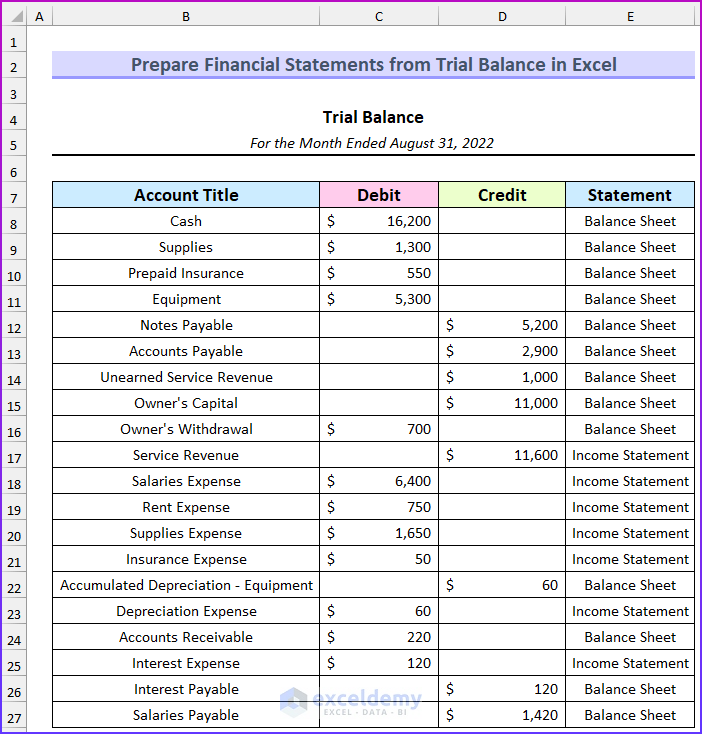

Once you’ve prepared your income statement, you can use the net income figure to start creating your balance sheet. The layout of a simple statement of financial position for a company for annual reporting purposes is legally defined. However, for management account purposes the layout should be in the format most useful for managing the business. The example below shows a typical and useful format for management purposes. The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out.

Usefulness of balance sheet

Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. In order to get a more accurate understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. Box 15.6 is a P&L statement because the bottom line (literally and figuratively) is the profit or loss from operating the business. This format lists those expense items alphabetically because the IRS tax form Schedule C lists them this way.

QuickBooks

Current liabilities are customer prepayments for which your company needs to provide a service, wages, debt payments and more. When investors ask for a balance sheet, they want to make sure it’s accurate to the current time period. It’s important to keep accurate balance sheets regularly for this reason. If he could convert some of that inventory to cash, he could improve his ability to pay of debt quickly in an emergency.

Shareholders Equity Section

For example, the assets, particular the long term assets are normally shown at cost or revaluation at a point in time, they do not show the current market value of those assets. If the shareholder’s equity is positive, then the company has enough assets to pay off its liabilities. Find more balance sheets and accounting templates in this collection of the top Excel templates for accounting. For an easy-to-use online balance sheet template, see this basic balance sheet template. The assets section is ordered in terms of liquidity, i.e. line items are ranked by how quickly the asset can be liquidated and turned into cash on hand. When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later.

Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity. This category is usually called “owner’s equity” for sole proprietorships and “stockholders’ equity” or “shareholders’ equity” for corporations. It shows what belongs to the business owners and the book value of their investments (like common stock, preferred stock, or bonds). In this way, the balance sheet shows how the resources controlled by the business (assets) are financed by debt (liabilities) or shareholder investments (equity). Investors and creditors generally look at the statement of financial position for insight as to how efficiently a company can use its resources and how effectively it can finance them. A balance sheet explains the financial position of a company at a specific point in time.

The first asset class is “Cash” (or items we can quickly convert into cash). For example, most people will not sell their house or car when they retire, so these assets are not used for retirement or investment planning purposes. Business‐use assets should generate income at a level that gives a reasonable return on the investment. These assets are often sold at retirement and can become a part of the retirement portfolio.

As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. This financial statement lists everything a company owns and all of its debt. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity.

Returning to our catering example, let’s say you haven’t yet paid the latest invoice from your tofu supplier. You also have a business loan, which isn’t due for another 18 months. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease.

No Comments